|

The SEC’s female Inspector Clouseau

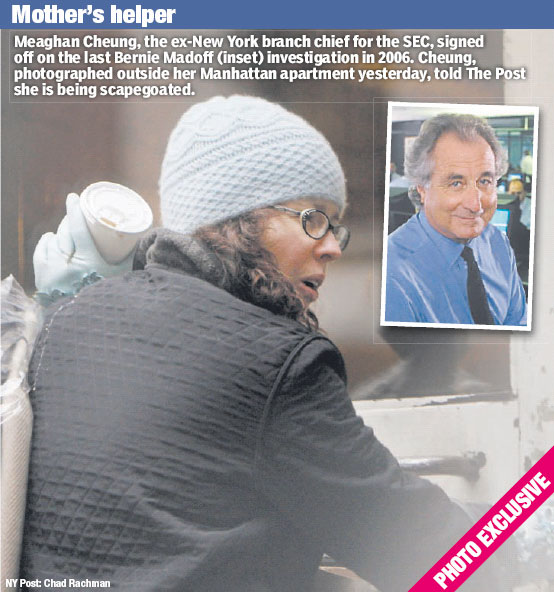

The other day I linked the amazing Wall Street Journal report that the Securities Exchange Commission had conducted eight investigations of Bernard MADE-OFF over the last sixteen years and had failed to uncover perhaps the biggest act of private theft in the history of the world. Yesterday’s New York Post has an exclusive on Meaghan Cheung, branch chief of the SEC’s New York enforcement division during its 2006 probe of Madoff’s company. After whistleblower Henry Markopolos gave Cheung a long memo in fall 2005 stating that “Madoff Securities is the world’s largest Ponzi scheme,” she and two female colleagues authorized an investigation, found nothing amiss, and gave Madoff a clean bill of health. Speaking tearfully to the Post outside her apartment building on Tuesday, Cheung claimed complete innocence for her failure to see what was in front of her eyes. Well, yes, if innocence means lack of knowledge of good and evil. In an April 2008 memo to the SEC, Markopolos had said about Cheung: “I did not believe that she had the derivatives or mathematical background to understand the violation.” [Italics added.] I wonder what her salary was. A quarter mil? Also, she is white (see photo below).

THE SEC WATCHDOG WHO MISSED MADOFFLA writes:

Note Cheung’s use of two characteristic liberal phrases: “I was shocked,” and “It’s a tragedy.” For her to call the biggest act of theft in history a “tragedy” removes any moral judgment from what Made-off did; it becomes something unfortunate, rather than something wrong. Thus her inability, reported by Henry Marcopolos, to understand the nature of the wrong-doing he was charging against Made-off, is complemented by her nonjudgmental worldview which implicitly denies the very existence of wrongdoing. And her being “shocked” fits right into that. Marcopolos gave Cheung a memo in 2005 stating that Made-off was engaged in “the world’s largest Ponzi scheme.” And now, three years late, Cheung is “shocked” to find out that Made-off was engaged in the world’s largest Ponzi scheme. See my articles on “Shock”—liberals’ normal response to the non-liberal reality they refuse to acknowledge. Gintas writes:

When I saw that picture of Cheung I thought it was a picture of a bag lady.Flyboy writes from Canada:

I do not understand why one should require a degree in advanced mathematics to determine that a set of equity investments did or did not exist. Was it not the case that Madoff claimed to be investing clients’ money and that he in fact did nothing of the kind? How about simply checking for share certificates and/or reports from brokers and money managers? What does this derivative discussion have to do with the 2005 SEC investigation?LA replies:

Of course. Where were the investments? Where were the certificates showing that Madoff had in fact purchased tens of billions in various securities? He had been accused of running a Ponzi scheme, meaning that the securities he had supposedly purchased and was managing for his clients didn’t exist. Determining whether he actually had purchased those securities couldn’t be simpler. This level of incompetence makes you feel our whole civilization is on the Inspector Clouseau level.Andrew E. writes:

I recall reading, though I can’t remember where, that Markopolos had said Madoff claimed to achieve his returns through an investing strategy involving various combinations of options contracts. Markopolos attempted to back-test this supposed strategy and was unable to achieve the same returns that Madoff had reported, I believe this is what spurred him contact the SEC. To approach the problem from this angle, one would need some degree of knowledge in derivative securities to understand the payoff functions involved which can be quite complex, especially when they’re layered on top of one another. Madoff may have been counting on this. Regardless, I think this is where Markopolos is coming from when he said he didn’t think Mrs. Cheung was capable of understanding the problem. Of course, the people who go to the trouble to learn these complicated securities almost always end up at Wall Street banks or hedge funds where the real (funny) money is made, not the SEC.LA replies:

No news article has yet explained: why couldn’t the SEC simply check to see if Madoff Securities actually had purchased and was holding the securities it said it was holding? How difficult could that be? It seems to me that the Marcopolos angle on this turns the equivalent of a simple arithmetic problem into a calculus problem. Posted by Lawrence Auster at January 08, 2009 09:50 AM | Send Email entry |